Among several forms of gambling, the lottery is probably the most regulated. One of the most famous lottery games in the world is Powerball. No ticket matched all six numbers drawn on Monday night. The Powerball jackpot increased to $416 million, the largest of the year thus far. However, the ultimate winner will receive a considerably smaller reward after paying taxes.

The IRS treats net lottery wins as ordinary taxable income. You will, therefore, be responsible for paying federal income taxes on the remaining amount after deducting your ticket’s cost.

Only 25% is withheld by the IRS; the precise amount is determined by your tax bracket, which is determined by your winnings and other sources of income.

The winner of the next draw will receive the $416 million in 30 annualized payments or the $194.1 million lump sum cash payout, which is typically the more popular option.

If the cash distribution option is selected, the obligatory 24% federal withholding will reduce the prize to $147.5 million.

Powerball Jackpot Rises To $416 Million—Here’s What The Winner Could Take Home After Taxeshttps://t.co/eQkbzZNAgI pic.twitter.com/BWBZ0kejbL

— Forbes (@Forbes) March 18, 2025

Depending on their taxable income, the winner may subsequently be subject to a federal marginal rate of up to 37%, further reducing their earnings to $122.3 million.

There have been some wild stories of people who have fun with the lottery but could not manage their money. We are sharing a few stories here. Learn about these ten mistakes and misfortunes lottery winners have experienced in case you’re lucky enough to win the lotto.

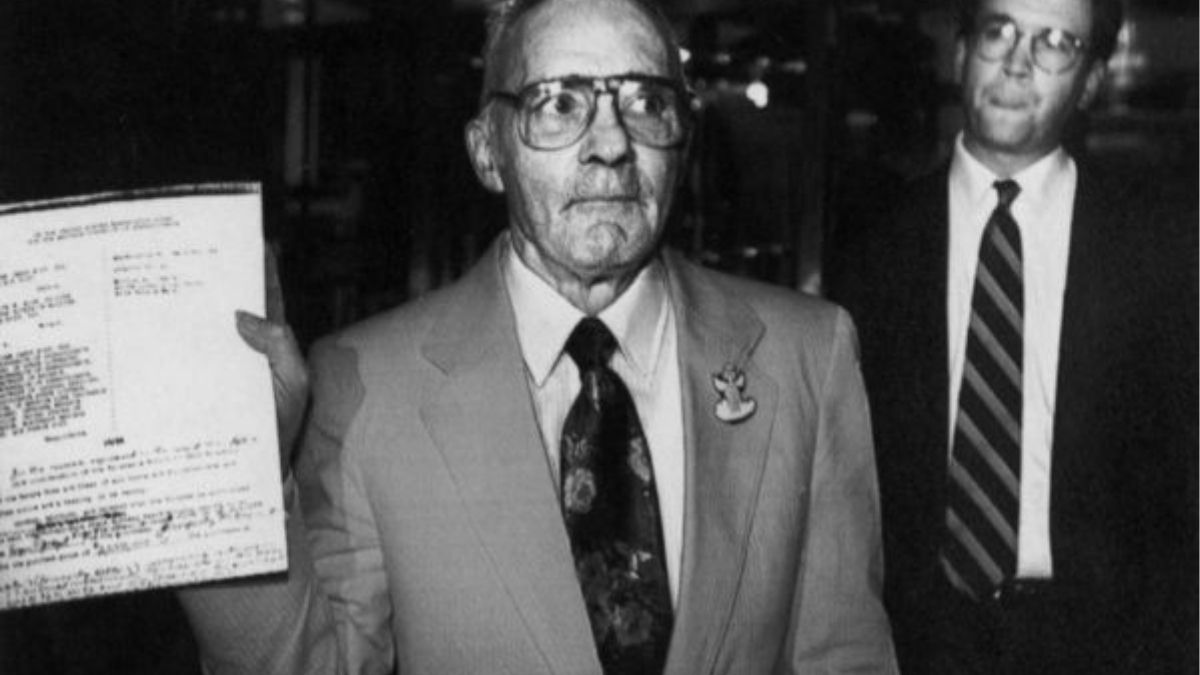

A 56-year-old truck driver from Brooklyn, NY has come forward as the winner of last year’s $298.3 million Powerball jackpot. pic.twitter.com/phnUoFvjU6

— TODAY (@TODAYshow) January 26, 2019

While some of these winners committed careless errors, others discovered that their winning tickets were lethal:

Do Not Give Your Friend Your Ticket

In Georgia, Jose Antonia Cua-Toc, an unauthorized immigrant, bought a winning lotto ticket in 2010. Because of his undocumented status, Cua-Toc was worried about claiming his wins. Though he didn’t win the powerball jackpot, he had won $750,000. He gave his supervisor, Erick Cervantes, the winning lottery ticket with the understanding that Cervantes would pick up the cash for him to prevent deportation.

His strategy backfired, and Cervantes took the money for himself, claiming that Cua-Toc had just bought the ticket for his friend. Fortunately, after seeing the surveillance camera evidence of the ticket purchase, courts decided in Cua-Toc’s favor in 2012.

Do Not Throw Your Ticket In Trash

A couple who won the lotto had a terrible experience when they unintentionally threw away their prize ticket. When Joanne and Joseph Zagmi went grocery shopping one day, they bought a scratch-off lottery ticket. The ticket got tossed with the trash in the bag. The next day, they remembered and dug it out of the dumpster.

The Zagami family didn’t win the powerball jackpot but received $1 million for this “garbage.”

Do Not Be Greedy

In 2012, John Ross Jr. won a $2 million lottery ticket. Though it was not a powerball jackpot, it was a large sum of money. Yet he could not mend his ways and was caught in a car theft. Before he could spend the money he won in the lottery, he was sentenced to jail. He had to spend his lottery earnings on a lawyer rather than a car he originally planned to.

Do Not Gamble Away Your Winnings

After winning the lotto twice in the 1980s, Evelyn Adams appeared extremely fortunate. She was a housewife. Then, her luck ran out. Adams wasted most of the $5.4 million she won from the lotto while trying her luck in Atlantic City.

Adams was helpful with the prize and offered money to anyone who asked for assistance, so it’s not that she was greedy with her windfall. Well, if she had won the powerball jackpot, she might have helped more people.

Do Not Seek Revenge

William “Bud” Post III won $16.2 Million in 1998. To keep the profits for himself, his brother attempted to hire a hitman to kill Post and his wife. Despite the failure of this assassination attempt, Post had a challenging life until he died in 2006.

He ultimately filed for bankruptcy before passing. He didn’t win the powerball jackpot. But he was compelled to give his landlady $5 million, and made an unsuccessful business investment.

Do Not Trust Anyone

Etta May Urquhart invested her money in the California lottery for eighteen years. She was thrilled at finally winning $15 million. She gave the ticket to her son Ronny Orender to sign and claim Powerball jackpot on her behalf—almost like Cua-Toc did when she gave the ticket away. Urquhart’s kid stole the ticket and pocketed the cash. Urquhart was successful in bringing a fraud and abuse lawsuit against her son for stealing her earnings.

Nobody knows who will win the Powerball Jackpot. We hope they don’t make these six mistakes. Lotto can give you money, and you can buy things. But one can not buy happiness or friends.