The Wall Street Journal’s Editorial Team did not seem to hold back as they called out President Donald Trump, wondering whether he understood money. In one of their recent pieces, which was published in the Journal’s Opinion column, the team had a no-filter approach, questioning whether he understood the intricacies of money and how it worked.

“Does President Trump understand money? Not money as in cash, but the supply of money, the price of money as measured by interest rates, and their impact on inflation?” the story began.

The very next line read, “The answer would appear to be no after Mr. Trump called for lower interest rates on Wednesday—the same day the Labor Department reported an increase in inflation for the third straight month.”

View this post on Instagram

To the unaware, the Labor Department has released a report that corroborates that the January consumer price index increased 3% from 12 months earlier. It was a staggering rise from what was considered a three-and-a-half-year low of 2.4% in September.

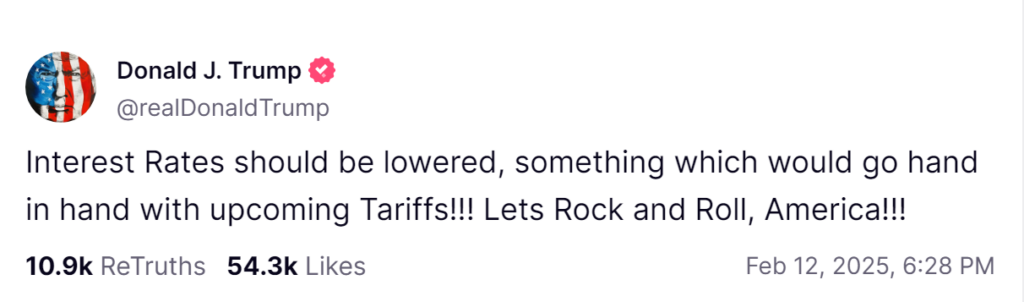

The Journal story also mentioned Donald Trump’s post on his social media platform, Truth Social, where he called for the lowering of interest rates, claiming that it is something that “would go hand in hand with upcoming Tariffs!!!”

This post was scrutinized by the Journal, whose team pondered whether Trump “wants the public to look elsewhere when assigning blame for rising prices.” They also pointed out that a surge in tariffs would directly result in a surge in the prices of the goods that are affected by it.

However, the Journal’s criticism and scrutiny stopped there as they pointed out that Donald Trump wasn’t responsible for this surge as it has only been 3 weeks since he has been in office. They pointed out that the inflation hike was a result of the Federal Reserve cutting the interest rate by 50 basis points in September and by another 25 points in November.

The Journal further pointed out that the Fed Chair, Jerome Powell, seems to have realized this mistake as he has repeatedly been asserting for weeks that the central bank is not inclined to cut the rate anytime soon. They also suggested that Trump shouldn’t push Powell to slash the rate any further as it would only lead to another spike in inflation.

View this post on Instagram

While they thought that Powell wouldn’t play by Trump’s demands, they did emphasize why the latter would still push for a slash in the interest rate, labeling his process as “Trumpanomics.” Given Donald Trump’s background in real estate, he would always go for lower interest rates and a weaker dollar, as it would lead to high prices.

The story ended with a warning of sorts that spikes in inflation could spell the doom of Donald Trump’s presidency, citing how the masses voted for him due to inflation and plummeting real incomes in the Joe Biden era.

The editorial team highlighted how real average earnings have flatlined over the last 3 months owing to the inflation spike, ending the piece on a slightly ominous note, that read, “If this persists, Mr. Trump won’t have a 53% job approval rating for long.”