Donald Trump Stories

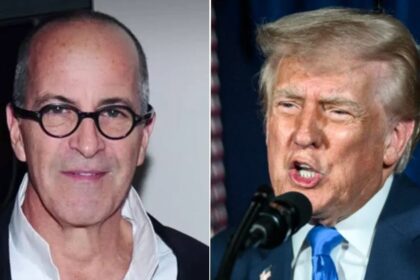

Donald Trump’s Primetime Speech Sparks Backlash After Fox News Anchor Calls Out “Impossible Math”

President Donald Trump faced criticism after his prime-time address from the White House on Wednesday night. During the speech, he…