Donald Trump Stories

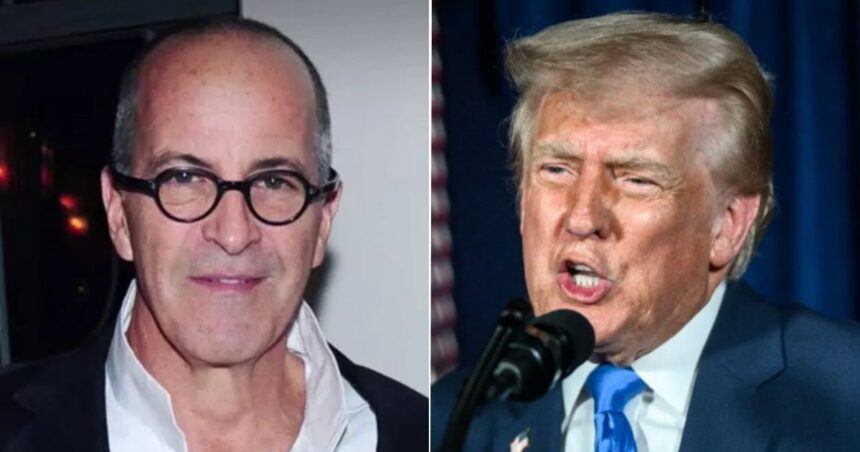

Mark Epstein Blasts Trump, ‘Jeffrey Definitely Had Dirt on Him’ — White House Pushes Back

Deceased s** offender Jeffrey Epstein’s brother, Mark Epstein, refuted a recent White House claim about President Donald Trump’s whereabouts during…